Tax Collector/ Utility Collector

Diana Spina

Tax Collector

Sandi Critchlaw

Utility Collector

Tax Collector

Utility Collector

You can pay your property taxes, water, and sewer bills using our online payment service. A per transaction service fee of 2.95% of the total bill will be charged by the payment processing company for this service.

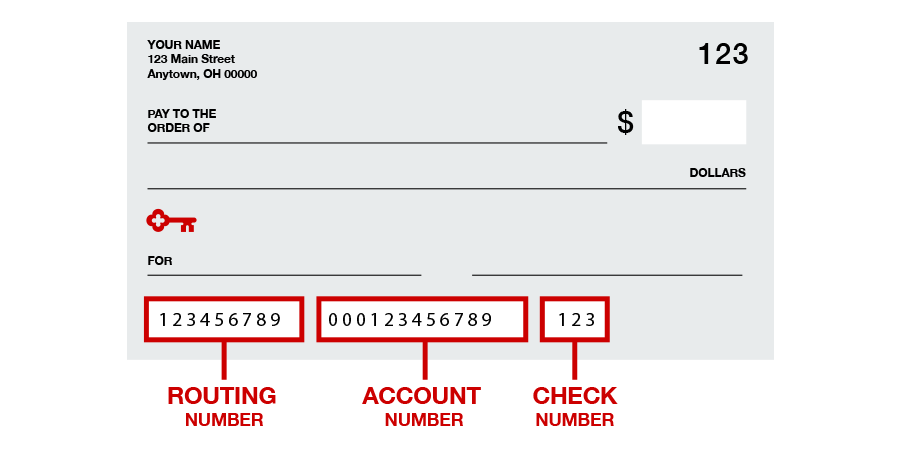

Wharton accepts electronic check payments using our online payment service. Payments will be charged to your checking or savings account at your bank. You will need your 9-digit routing number, as well as your account number from your personal checks (see example below). A per transaction service fee of $1.95 will be charged by the payment processing company for this service.

Tax Information is now available online. Please click here to access the online look up system.

Click here for a brochure on Property Taxes in New Jersey.

Tax Collector

Utility Collector

As a statutory officer of the State of New Jersey, the Tax Collector is obligated to follow all the State Statutes regarding property tax collection. Property taxes are due on a quarterly basis. Tax bills are mailed once a year during the summer and the first payment is due August 1. This bill covers the last half of the current year and the first half of the following year. The due dates for each quarter are printed on the payment stubs of the bill and are as follows:

February 1, May 1, August 1, and November 1.

There is no discount for pre-payment. Failure to receive a tax bill does not exempt you from paying taxes or the interest due on delinquent taxes.

There is a ten calendar day grace period each tax quarter for payment of taxes without interest being charged. If the 10th day falls on a weekend or holiday, taxpayers will have until the next business day to pay without penalty. If payment is not received by the last day of the grace period, interest reverts back to the 1st of the month.

NOTE: When mailing payments without a payment stub, please specify that your payment is for Property Tax and indicate property address, block and lot, and/or tax account number.

*If you did not receive a bill in the mail, please contact your postal carrier. If it is getting close to a due date for one of your bills and you haven't recieved it you can either check online or call Town Hall for the amount due.*

Sewer bills are due on a quarterly basis. They are mailed once a year in the beginning of the year and are due February 1, May 1, August 1, and November 1.

There is no discount for pre-payment. Failure to receive a sewer bill does not exempt you from paying for sewer or the interest due on delinquent sewer charges.

NOTE: When mailing payments, please specify that your payment is for Sewer.

Water bills are due on a quarterly basis. They are mailed quarterly and are due March 1, June 1, September 1, and December 1 1.

Failure to receive a water bill does not exempt you from paying for water or the interest due on delinquent water charges.

NOTE: When mailing payments, please specify that your payment is for Water.

*If you did not receive a bill in the mail, please contact your postal carrier. If it is getting close to a due date for one of your bills and you haven't recieved it you can either check online or call Town Hall for the amount due.*

You can pay taxes or utilities via cash, check, money order, or by credit card online

You can pay taxes or utilities in the following ways:

Remittances requiring a receipt must be accompanied by a self-addressed, stamped envelope.

For information about the State of New Jersey's Low-Income Household Water Assistance Program click here.

The State of New Jersey has a number of property tax relief programs such as the ANCHOR Program, Senior Freeze Program, and Stay NJ Program. The filing and approval of all applications are handled at the State level.

Click here to see what programs are available.

New in 2025 is a single combined application for Senior/Social Security Disability Recipients for ANCHOR, Senior Freez, and Stay NJ. For the application click here.

If the Assessor establishes an added assessment on a property for improvements made, the tax bill for the added assessment is mailed in October and due November 1. These bills are sent to the property owner only, and not to the mortgage holder. If the mortgage holder normally pays the taxes, the property owner is responsible for ensuring that the taxes are paid. If the Assessor establishes an added assessment on a property for improvements made, the tax bill for the added assessment is mailed in October and due November 1. These bills are sent to the property owner only, and not to the mortgage holder. If the mortgage holder normally pays the taxes, the property owner is responsible for ensuring that the taxes are paid.

Each year, there is a Tax Sale for unpaid taxes and other municipal charges from the previous year. A list is published in the newspaper for four weeks preceding the sale and the cost of sale is added to the delinquent amount owed. The amounts due, however, may be paid up to the day before the sale in the form of a certified check, cash or money order. If the delinquent accounts are not cleared and the property goes into the sale, a lien is placed against the property. If the lien is picked up by the Borough of Wharton, foreclosure proceedings will begin six months from the date of the sale. If an outside buyer picks up the lien, he must hold it for two years from the date of sale before starting foreclosure proceedings. All liens must be paid by cash, certified check or money order.

Tax bills and Sewer bills should be given to the new owner or his paying agent upon closing. A charge may be imposed for a duplicate bill. A final water meter reading must be scheduled when there is a change of ownership or tenant.